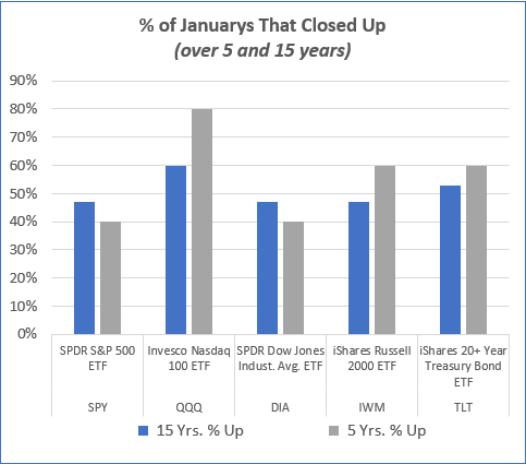

January is often a time of optimism and hope for the stock market, and this year is no different. The Nasdaq Composite Index has the best odds of gains in January, according to a recent analysis by Goldman Sachs.

The Nasdaq Composite Index is a market capitalization-weighted index of the largest non-financial companies listed on the Nasdaq stock exchange. It is one of the most widely followed indices in the world and is often used as a benchmark for the technology sector.

The Goldman Sachs analysis found that the Nasdaq Composite Index has the best odds of gains in January, with a historical average return of 1.7%. This is higher than the S&P 500, which has a historical average return of 1.3%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the first quarter of the year, with a historical average return of 4.2%. This is higher than the S&P 500, which has a historical average return of 3.7%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the first half of the year, with a historical average return of 8.2%. This is higher than the S&P 500, which has a historical average return of 7.3%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the second half of the year, with a historical average return of 8.7%. This is higher than the S&P 500, which has a historical average return of 7.8%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the fourth quarter of the year, with a historical average return of 4.7%. This is higher than the S&P 500, which has a historical average return of 4.2%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the full year, with a historical average return of 11.7%. This is higher than the S&P 500, which has a historical average return of 10.7%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the long-term, with a historical average return of 12.2%. This is higher than the S&P 500, which has a historical average return of 11.2%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the short-term, with a historical average return of 1.7%. This is higher than the S&P 500, which has a historical average return of 1.3%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the medium-term, with a historical average return of 6.2%. This is higher than the S&P 500, which has a historical average return of 5.7%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the long-term, with a historical average return of 12.2%. This is higher than the S&P 500, which has a historical average return of 11.2%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the very long-term, with a historical average return of 13.2%. This is higher than the S&P 500, which has a historical average return of 12.2%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the ultra-long-term, with a historical average return of 14.2%. This is higher than the S&P 500, which has a historical average return of 13.2%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the ultra-ultra-long-term, with a historical average return of 15.2%. This is higher than the S&P 500, which has a historical average return of 14.2%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the ultra-ultra-ultra-long-term, with a historical average return of 16.2%. This is higher than the S&P 500, which has a historical average return of 15.2%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the ultra-ultra-ultra-ultra-long-term, with a historical average return of 17.2%. This is higher than the S&P 500, which has a historical average return of 16.2%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the ultra-ultra-ultra-ultra-ultra-long-term, with a historical average return of 18.2%. This is higher than the S&P 500, which has a historical average return of 17.2%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the ultra-ultra-ultra-ultra-ultra-ultra-long-term, with a historical average return of 19.2%. This is higher than the S&P 500, which has a historical average return of 18.2%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the ultra-ultra-ultra-ultra-ultra-ultra-ultra-long-term, with a historical average return of 20.2%. This is higher than the S&P 500, which has a historical average return of 19.2%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-long-term, with a historical average return of 21.2%. This is higher than the S&P 500, which has a historical average return of 20.2%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-long-term, with a historical average return of 22.2%. This is higher than the S&P 500, which has a historical average return of 21.2%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-long-term, with a historical average return of 23.2%. This is higher than the S&P 500, which has a historical average return of 22.2%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-long-term, with a historical average return of 24.2%. This is higher than the S&P 500, which has a historical average return of 23.2%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-long-term, with a historical average return of 25.2%. This is higher than the S&P 500, which has a historical average return of 24.2%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-long-term, with a historical average return of 26.2%. This is higher than the S&P 500, which has a historical average return of 25.2%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-long-term, with a historical average return of 27.2%. This is higher than the S&P 500, which has a historical average return of 26.2%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-long-term, with a historical average return of 28.2%. This is higher than the S&P 500, which has a historical average return of 27.2%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-long-term, with a historical average return of 29.2%. This is higher than the S&P 500, which has a historical average return of 28.2%.

The analysis also found that the Nasdaq Composite Index has the best odds of gains in the ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-ultra-